The global crises of recent years have highlighted all the shortcomings of the world's financial systems. Lending decreased by almost 50%, repayment of loans by 29%, recognition of creditors as bankrupt by 18.7%, which has very negative consequences for the financial sector. That is why factoring is becoming one of the main financial tools today.

Today, factoring is in the center of attention of many scientists, both domestic and world-renowned. First of all, the world scientists should include: M. Auboin, E. Hoffmann, Duff, V., L. Klapper, E. Onaepemipo, and the domestic ones: N. Vnukova, O. Dobrovolska, M. Dubina, A. Zhavoronok. M. Kozakova, B. Konarivska, L. Momot. O. Palchuk, L. Pankratova, N. Radukh, O. Shabanova, I. Furman and others.

According to the Law of Ukraine "On Banks and Banking Activity" factoring is the acquisition by a bank of the right to demand the use of obligations in monetary form for delivered goods or services assuming the risk of fulfilling such requirements and accepting payments [2]. Behind this rather complex definition is a simple explanation, i.e. factoring is the purchase of debt.

Modern factoring will always be a set of services that includes:

Ľ information service for the client (the factor always gives recommendations to the client regarding cooperation with his debtors, points out doubtful moments of the debtor);

Ľ legal support of factoring operations, the client's work with his debtors;

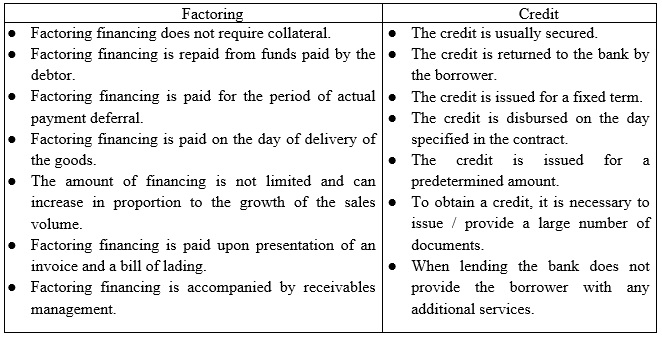

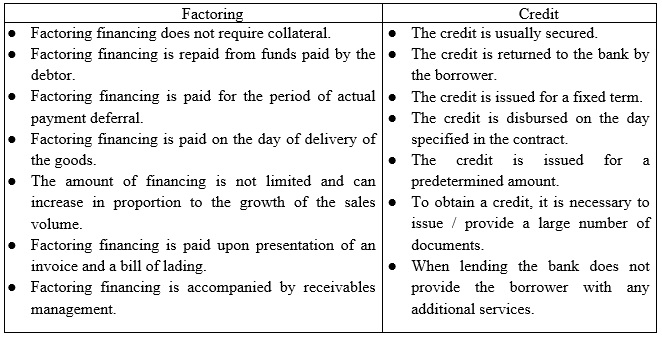

Ľ management of the client's receivables, i.e. administration (which involves work to recover debts from the debtor). Since factoring refers to services of a credit nature, it would be appropriate to consider the differences of this service before a loan (Table 1).

Table 1 - The main differences between factoring and credit

Source: developed by the author based on [4]

So, based on this table, it is possible to identify such advantages of factoring as [3]:

● the enterprise receives the possibility of financing working capital without security (collateral);

● factoring accelerates the cash turnover period;

● compared to standard credit products, such as an overdraft, factoring allows you to receive up to 90% of the amount of delivered goods (future income).

● factoring is an opportunity to provide more favorable (competitive) settlement terms to its debtors (buyers).

● with the help of factoring, the state of the client's receivables is improved. The factor checks the debtor's reputation and payment discipline, ensures that the debt is paid on time and in full.

Among the disadvantages of factoring operations, the following are distinguished [1]:

● high requirements of the bank for the documents provided for sale;

● in many cases - the need for a guarantee for the client (what is called recourse factoring);

● factoring price. Today, factoring is not a cheap service. If we draw a parallel, then factoring is a boutique product. The average price of factoring operations in the complex is about 30% per annum. Although the price factor, despite all its importance, is not the primary factor when choosing a factoring "producer".

Therefore, the use of factoring compared to a credit enables enterprises: to speed up the turnover of working capital, to optimize cash flow, to increase the number of buyers, to insure the risks of non-payment, to expand its market share, to increase its liquidity. The development of factoring will contribute to the economic growth of the country, because it provides a higher level of solvency, financial stability of enterprises and increasing in sales volumes due to the possibility of delaying payment.

References:

1. Dubina M. V., Zhavoronok A. V., Dubina P. V. Analysis of the current state of the factoring services market in Ukraine. Problems and prospects of economics and management. 2017. No. 4(12). P. 134-145. URL: http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR=20&S21STN=1&S21FMT= ASP_meta&C21COM=S&2_S21P03=FILA=&2_S21STR=ppeu_2017_4_19

2. Law of Ukraine "On Banks and Banking Activities", Document No. 2121-III, valid, current edition Ś edition dated 05.02.2023, basis - 2881-IX. URL: https://zakon.rada.gov.ua/laws/show/2121-14#Text

3. Petrenko V.S., Karnaushenko A.S., Borovik L.V. Factoring: the essence, types and its advantages in the financial activity of enterprises. Electronic scientific publication "Efficient Economy". 2021. No. 11. URL: http://www.economy.nayka.com.ua/pdf/11_2021/16.pdf

4. Factoring in Ukraine. URL: https://bankchart.com.ua/business/factoring#1

____________________

Language advisor: Natalia B. Zjubanova, senior lecturer of Foreign Languages Department, National Aerospace University named after N. E. Zhukovsky "KhÓrk│v Aviation Institute", Ukraine

|