|

|

|

METHOD OF SMALL BUSINESSES BALANCE: NEW CURRENT UKRAINIAN LEGISLATION

| |

| 14.04.2012 11:40 |

|

Автор: Tsarenko Mikhail, Student, V.N. Karazin Kharkiv National University

|

|

[Секція 3. Облік, статистика і аудит;] |

Order of the Ministry of Finance of Ukraine of 09.12.2011, № 1591 in the P (S) A 25 «Financial Report of the subject of small business» made significant changes that require attention and worthy of analysis, namely:

1. We outline a procedure for preparation of small business (hereinafter - SB) financial statements of the International Financial Reporting Standards,

2. Fleshed out the procedure for compiling the financial statements of single tax payers,

3. Approved form of a simplified financial statement of SB.

In the present study we will analyze features of application and compiling Simplified balance of SB (Form 1-ss) and mark the main differences between this form of account of the Balance Sheet of SB drawn up to the 1st form.

The main feature is the following: the Simplified Balance Sheet (Form 1-ss) can only be applied by SBs required under the terms outlined in the Tax Code of Ukraine (hereinafter - TCU).

The conditions are:

• SB is the payer of income tax at a rate of 0% and has the right to use a simplified accounting of revenues and expenses (TCU p.154.6 meet the criteria), or

• SBs are the single tax (p.291.4 TCU: Group 4 - entities with average recorded number of employees is not more than 50 persons and the amount of income is not more than 5 mln. UAH).

Thus, the choice between the SB forms of financial reporting, mandatory to compile, does not depend on a willingness of management personnel, and on the correspondence of this SB specifically designated in the regulations the conditions and criteria.

For SB entitled to Simplified preparation of the financial report, it is necessary to know the content of articles of Simplified balance sheet (Form 1-ss). Knowledge of the structure of the report document before making such a report helps to organize accounting in the enterprise. Because of this, as well as by selecting the appropriate form of accounting a sufficient degree of informativeness of accounting records and details of the enterprise is reached. This, in turn, contributes to the fact that the preparation of any reports, including financial ones, will not be unnecessarily complicated and time consuming.

We emphasize the important points that continue to operate even in the preparation of simplified balance sheet (Form 1-ss): «folding» of assets and liabilities is not allowed, except as provided in the relevant P (S) A, SBs that have the right to use a simplified accounting of income and expenses are taken into account only the non-current assets at original historic cost without reducing the utility and the revaluation to fair value, do not create software for future expenses and payments (the holiday payment to employees, implementation of warranty, etc.) and recognize the costs involved in times their actual implementation; recognized income and expenses to the requirements of TCU and include amounts that are not recognized as income or expense by TCU, directly on the financial result after tax levying, the current accounts receivable balance includes up to its actual amount (without charging provision for doubtful debts).

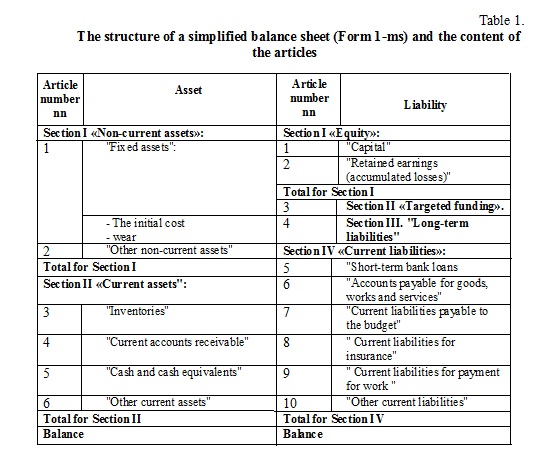

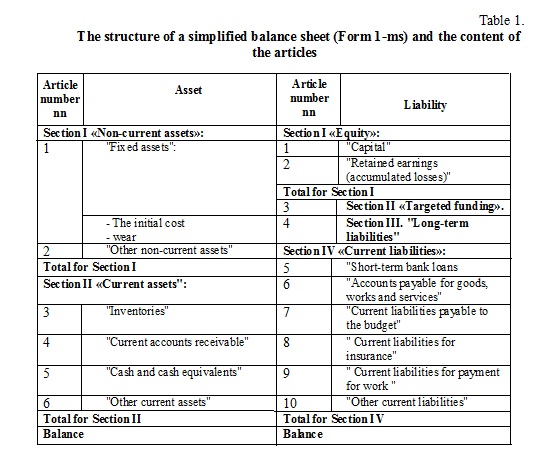

For clarity, the structure of the simplified balance sheet (Form 1-ss) on the Table 1.

In order to understand how simplified balance sheet (Form 1-ss) became far simpler and easier to make than of the former form of the Balance Sheet of SB drawn up in form of 1-s, draw a little comparative analysis of the content and amount of assets and liabilities:

• Total assets in the balance in the form of 1-ss - 6 articles (13 lines entered), and in the form of the 1- s - 16 articles (27 lines entered)

• Total liabilities in the balance in the form of 1-ss - 10 articles (13 lines entered), and in the form of the 1 - s - 16 articles (18 lines fit into).

As you can see, the detail information in a simplified balance sheet (Form 1-ss) is significantly less than in the balance of SB in the form of 1-s: the number of lines fit into and are reflected by articles significantly decreased. Of course, making such a simplified balance sheet (Form 1-ss) is easier, what is the essence of the simplification.

If you do not analyze the number of members, and meaningful (economic) content of the information provided in the articles Simplified balance sheet (Form 1-ss), the hallmarks of the new reporting form is the combination of the following information:

1. The article «Fixed Assets» provides information not only about their own basic tools, but also obtained under a financial lease, the integral property complexes, as well as the value of property received on the rights or operational management, as well as objects of investment property, intangible assets, long-term biological assets and outstanding capital investment.

2. Article «Other non-current assets» reflects not only the amount of other non-current assets, but also long-term financial investments in the balance allocated to SMEs in the form of 1-s in a separate article.

3. In the article "Supplies" information on the cost of supplies of raw material, basic and auxiliary materials, fuel, purchased semi-finished goods and components, spare parts, container (except for a inventory), build materials and other materials, intended for the use during a normal operating cycle is represented. In this article charges are also pointed on the uncompleted production and uncompleted works (services), gross debt of customers on build contracts, current biological assets, prepared products, agricultural products.

4. The article «Current accounts receivable» reflect the actual debt of buyers for sold products, goods, works or services, including promissory notes receivable from other debtors, recognized outstanding treasury, financial and tax authorities, state trust funds, including estimated for temporary disability. Special attention should be paid to reflected in this article the asset balance of a debt-ss founders to build equity. In the balance of SBE in the 1st form the 1st, this information is reflected not just in another article, but in another section of the balance: as «Paid-in capital» (with the sign «minus» as a contra account) in liabilities in the «equity».

5. Article «Other current assets» reflects the sum of all current assets not included in other articles, including and the amount of current financial investments in the balance allocated to SMs form the 1st in a separate article.

6. In the article "Capital" the sum of the chartered capital of enterprise actually brought in by founders (by proprietors) is pointed. Also represented cost gratis got by a enterprise from other legal or physical entities of non-current assets and other types of additional capital. In this article sum of a ration capital (ration payments) of members of consumer society is also pointed, as well as unions and other organizations, payments of founders of enterprise over the chartered capital, sum of operating surplus.

7. Amounts of revenues and expenses in future periods do not stand out in separate sections, and are included in other current assets and other current liabilities.

Thus, the analysis of changes in the order of the financial statements of SB, showed that indeed making a new form of simplified balance sheet (Form 1-ss) is considerably simplified. Meanwhile detail is lost in the balance of information provided. However, this is an inevitable consequence of such changes.

References:

1. Tax Code of Ukraine of 02.12.2010, № 2755-VI. 2. P (S) A 25 «Financial Report of the subject of small business», as approved by the Ministry of Finance of Ukraine of 25.02.2000 № 39 (as amended).

|

|

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License

|

|

|